Through Curiocial, we previously explored how computer chips were produced and discussed their current state. Right now America and China about to star a war in chip production. But Europe made the first big move; confusing, right? Let me break it down for you.

US and European officials are becoming increasingly worried over China's rapid surge into producing older-generation semiconductors, particularly legacy chips that play vital roles in various global industries, from smartphones and electric vehicles to military hardware.

President Joe Biden instituted comprehensive controls limiting China's access to advanced chips used for AI models and military purposes, but Beijing responded by investing billions into legacy chip factories that produce legacy chips, not banned.

This situation has raised fresh fears regarding Chinese potential influence, prompting additional containment strategies being discussed among global decision-makers.

Commerce Secretary Gina Raimondo recently made headlines when she pointed to China's subsidization of excess capacity for mature and legacy chips, creating a serious issue that requires close collaboration among allies to resolve effectively.

Although no definitive timeline for action has been set by the Biden administration yet, all options are currently under active consideration.

US and European officials share genuine reservations over China's efforts to corner the legacy chip market from both economic and security viewpoints.

A primary worry among officials in both regions is that Chinese firms could flood global markets with legacy chips similar to what occurred with solar cells, potentially harming foreign competitors who operate within that sector.

China's increasing dependence on key tech components poses national security threats, particularly if these chips are integrated into defense equipment.

Western businesses may become dependent upon Chinese supply chains for parts that make up such equipment. This could threaten the strategic autonomy of US allies and imperil US sovereignty and its allies' strategic autonomy.

Researchers from Stanford University's Hoover Institution think tank advises being watchful against nonmarket behavior by emerging Chinese semiconductor firms that could have long-term ramifications and create dependency chains within China itself.

Legacy chips emerged as important commodities during supply shocks brought on by the Covid pandemic, as companies such as Apple Inc. and car manufacturers experienced dramatic sales losses due to shortages.

Legacy chips play an essential part in smartphones, electric vehicles, and military gear like missiles and radar.

Europe and North America are working towards decreasing their dependence on Asian chip manufacturers by increasing their domestic production of chips.

Governments are allocating public funds towards local factories like Vice President Biden's $52 billion CHIPS and Science Act initiative.

However, domestic chip producers might be wary of investing in facilities competing with heavily subsidized Chinese facilities; this poses an obstacle for the US and its allies as they try to promote stronger semiconductor industries.

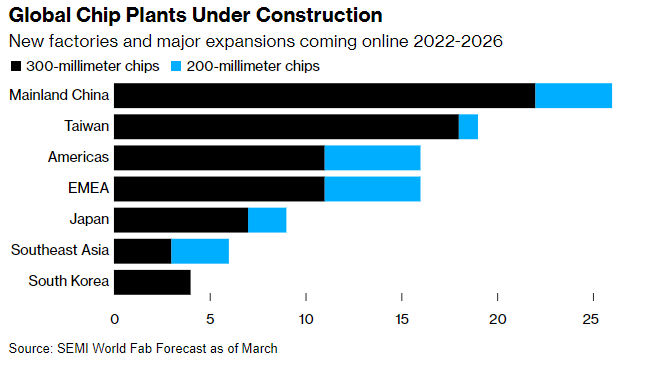

US regulations may have dampened China's development of advanced chipmaking capabilities, yet older techniques still need to be explored. Chinese firms are rapidly building new plants using 200 and 300-mm wafers, their number surpassing those located within America itself.

Even amid rising tensions between Washington and Beijing, heavy investments by Chinese firms have enabled them to continue providing products to Western clients such as Qualcomm.

China's chipmaking champion Semiconductor Manufacturing International Corp, still received about 20% of sales last year from American customers, including clients like Semiconductor Manufacturing International Corp (SMIC).

Source: bloomberg.com