Viasat Inc. is no stranger to space, with over $1 billion worth of satellites orbiting our Planet Earth. Unfortunately, however, some have encountered unexpected issues that are sending shockwaves through the space insurance industry.

At the core of this cosmic mystery lies ViaSat-3 America's satellite, valued at nearly $1 billion and designed to extend coverage for fixed broadband services while competing against formidable opponents like Elon Musk's Starlink satellite. Unfortunately, when installing its antenna back in April, there was an unexpected hitch that necessitated replacement due to incompatibilities between it and ViaSat-3 Americas' antenna placement process.

ViaSat-3 takes an unexpectedly dramatic turn with the possibility of declaring its total loss, creating far-reaching ramifications if this declaration comes to fruition estimates for its insurance claim could easily top $420 million and has far-reaching repercussions for other satellite operators seeking coverage as it creates ripple effects that threaten accessibility for everyone involved in space activities.

Multiple Policies for the Costly ViaSat-3: A Shift in the Space Insurance Landscape?

ViaSat-3 satellite may be covered by multiple insurance policies from different providers to reduce the financial risk associated with insuring such an immense asset, reflecting insurers' willingness to spread out this responsibility rather than take on all its value at once. This method also protects it from theft of its valuable components and its equipment, unlike taking on all its value alone, which would do so much more harm.

Denis Bensoussan of Beazley Insurance leads satellite insurance with his emphasis on adopting a collaborative risk approach. This sentiment is shared among other major insurers whose roles as underwriters remain confidential, an approach driven by understanding all of its inherent risks.

Inmarsat-6 F2, launched into space this February, has recently experienced power problems that threaten its useful life and may require it to be retired early. An anticipated outcome would result in an insurance claim of $350 Million, yet more evidence of how ephemeral space ventures truly are.

American International Group Inc. and Allianz SE have both left the space insurance arena, leaving only smaller insurers like Allstate Corporation to bear the immense risks that exist within its $553 million market. Telecom giants remain keen on coverage, while players who focus more heavily on smaller satellite launches may care less.

Viasat remains tight-lipped regarding any plans to file an insurance claim; however, investors suggest otherwise: the day following ViaSat-3's issues in July alone saw its shares plummet 28% freefalling, though expected only to impact approximately 13% of the fixed broadband business, these reverberations ripple throughout the industry as whole.

Past Troubles and Future Challenges: ViaSat-2 Anomaly and Insurance Dynamics

ViaSat-3's struggles bring back memories of its predecessor, ViaSat-2 satellite launched in 2017. Launched in 2017, this satellite experienced an antenna anomaly, which resulted in a $188 million insurance claim. However, the ViaSat-2 hiccup was unwelcome news at first. Ongoing struggles from SpaceX compounded the pain significantly.

Experts predict that following the Inmarsat-6 anomaly, both Viasat and other industry players will face considerable insurance issues that compound industry uncertainty. Navigating these difficulties appears daunting for future satellite launches requiring insurance coverage, adding further uncertainty for industry stakeholders.

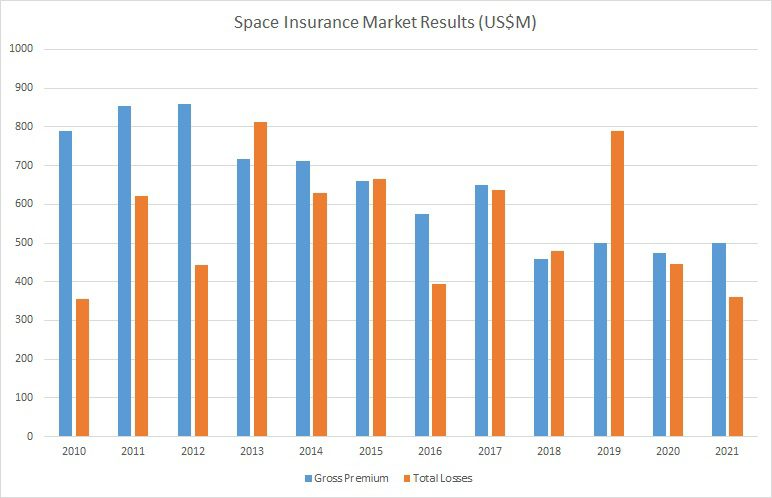

Unexpected loss can trigger a cascading chain reaction within space insurance. When massive satellite losses happen, insurers often flee quickly, resulting in premium increases across different industries, as evidenced by 2019 when satellite claim losses exceeded total premiums by almost fivefold, with losses reaching $788 million against total premiums of $500 million, according to Seradata's data.

The Power Struggle in Space Insurance

American International Group Inc., Swiss Re AG, and Allianz SE's departure have had serious repercussions for insurance. Amid reduced competition among remaining providers, those left are opting for more conservative strategies in an attempt to strike an equilibrium between risk and reward, creating uncertainty within the insurance landscape and prompting numerous questions as it changes dramatically over time.

Unravel the complex web of satellite insurance by beginning from its roots: property. Satellite operators like Viasat typically charge premiums to secure coverage during their satellite's initial year in orbit, including catastrophic launchpad failure scenarios that might arise, offering added peace of mind against unexpected costs and liabilities.

Size matters when it comes to insuring satellites for smaller satellites. Securing coverage from one insurer may suffice. As complex and valuable satellites increase in complexity and value, their coverage needs change. Larger satellites worth hundreds of millions require multiple insurers for comprehensive protection. Currently, 20-30 key players exist within this field of satellite insurance, each playing an essential part in shaping its dynamics.

The satellite insurance landscape is unique due to a unique dynamic: low frequency but high severity challenges. Satellite failures don't happen often, but when they do, they have severe consequences. Therefore, satellite operators require an effective yet well-balanced insurance strategy in place in order to remain protected and financially sustainable.

Due to insurers taking on increased payout costs, insurance premiums will inevitably rise over the coming months and years. Satellite operators could see rising costs. Experts anticipate this initial surge will eventually stabilize as industry equilibrium returns.

SpaceX's Starlink Bold Move and Its Ramifications

SpaceX's Starlink project has contributed significantly to this increase, unleashing mega-constellations of satellites into space that increase collision risk and may result in rate hikes for certain satellites. As the heavens become ever more congested, insurers and satellite operators alike must navigate a delicate balance of risk management.

SpaceX takes an intriguingly unusual tack when it comes to satellite insurance by electing not to insure its satellites. This decision speaks volumes about a shift in industry dynamics: as venture-backed companies join the space race with smaller satellites in low Earth orbit, demand for insurance has changed radically, with stakes dependent on size becoming the calculus of risk-taking on an entirely different aspect.

The space insurance market remains stable despite rapid industry development, an impressive feat that may be attributable, in part, to "missing premium," an aspect that helps maintain equilibrium despite rapid change within this space industry.

In-Orbit Insurance & Protecting Cosmic Assets

Delving deeper, let's investigate how in-orbit insurance works. This aspect of satellite coverage protects against various scenarios. A total loss occurs if physical destruction or inoperability of a satellite occurs, while partial loss (constructive total loss) arises if performance or service life impairment significantly compromises it. These nuances demonstrate the difficulty associated with effectively managing space endeavor risks.

Once we move away from micro levels to view the larger picture, an astonishing revelation surfaces: of all of Earth's satellites in orbit around it, only 238 have insurance that totals $24.7 billion! This provides insight into how risk and investment play out on our galaxy stage.

Launch insurance can ease some of this uncertainty during one of space exploration's many challenging moments, indemnifying satellite owners if there's ever been an unsuccessful launch, a malfunctioning vehicle, or a satellite failing to reach its desired orbit. Coverage typically ranges between $250 million to $300 million but comes at a premium ranging between 15%-25.

Satellite insurance stands out among other forms of protection by being comprehensive in nature, and its coverage stretches far and wide, from pre-launch coverage (to protect before launch occurs) through launch coverage and in-orbit operations coverage, not forgetting third-party liability protection to round off its protection strategy.

Although satellite insurance might conjure images of celestial bodies, its reach extends closer to home. Standard home policies usually cover exterior damage from natural elements like wind and hail however, coverage typically excludes damaged antennae/dishes, leaving homeowners to manage this aspect of protection themselves.

Space is home to more than operational satellites. It also shelters an abundance of space debris. Tracked by the United States Space Surveillance Network are over 23,000 pieces of junk that provide ample evidence of orbital clutter. Among these debris lie around 3,000 defunct satellites, which underscore how expansive space truly is.

Sources: bloomberg.com / viasat.com